Start building your whisky cask investment portfolio today.

Unlock the power of an investment that quite literally gets better with time. Whisky cask investment offers an unprecedented level of wealth security combined with a history of consistent returns across all economic cycles.

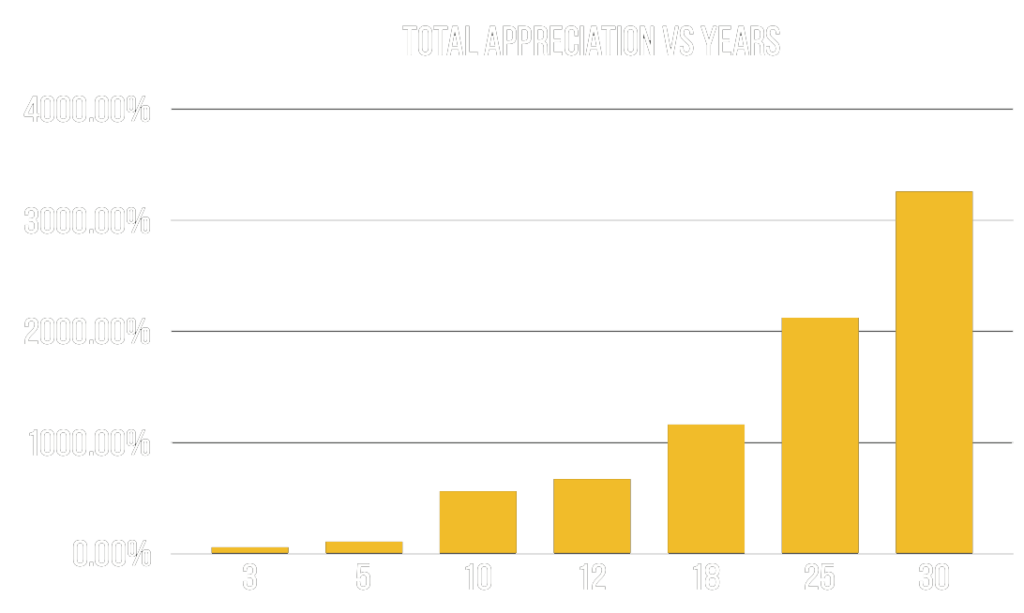

The above graph demonstrates the average appreciation in the value of whisky casks from time of distillation to 30 years of age. Casks will typically double in value every 5 years.